Illinois Gas Tax Set to Increase Automatically

Starting July 1, 2024, Illinois motorists will face a higher gas tax rate due to an automatic annual adjustment mechanism implemented by state legislation. As reported by MyStateline, this adjustment is part of a broader strategy to generate revenue for infrastructure improvements across the state. The automatic increase will see the tax rise by several cents per gallon, further burdening consumers already grappling with high fuel costs.

Understanding the New Gas Tax Rates

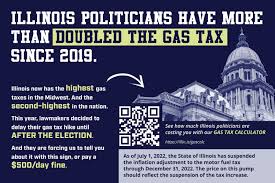

According to NBC Chicago, the new tax rates will raise Illinois’ position to having the nation’s second-highest gas taxes, further increasing the financial strain on motorists. The state’s gas tax is crucial for funding transportation projects, including road repairs and maintenance. However, critics argue that Illinois already imposes one of the heaviest tax burdens on gasoline in the country, negatively impacting residents and businesses alike.

Economic Implications and Public Reaction

Wirepoints highlights concerns over the economic implications of the tax hike, emphasizing that Illinois motorists are already burdened with high fuel costs compared to other states. The increase is expected to affect not only individual consumers but also transportation-dependent businesses, potentially leading to higher costs for goods and services statewide.

Impact on Illinois’ Transportation Infrastructure

The additional revenue from the gas tax increase is earmarked for supporting Illinois’ aging transportation infrastructure. Proponents argue that these funds are essential for maintaining and upgrading roads, bridges, and public transit systems, thereby improving safety and efficiency for all users. However, the effectiveness of such taxation in meeting infrastructure needs remains a subject of debate, especially given existing concerns over fiscal management and accountability.

Political and Policy Considerations

The decision to implement an automatic gas tax increase reflects ongoing policy debates within Illinois’ political landscape. Supporters contend that sustainable funding mechanisms are vital for long-term infrastructure planning and development. Conversely, opponents criticize the automatic nature of the tax hike, suggesting that it places an undue financial burden on taxpayers without sufficient transparency or accountability.

Looking Ahead: Challenges and Opportunities

As Illinois prepares for the upcoming fiscal year, the impact of the gas tax increase on the state’s economy and public sentiment remains uncertain. The debate over taxation policy and infrastructure funding is likely to continue shaping political discourse and legislative priorities in the months ahead. Moreover, the effectiveness of revenue generated through increased gas taxes in addressing Illinois’ infrastructure needs will be closely monitored by stakeholders across various sectors.

Also Read:

- Health Alert: West Nile Virus Found in Winnebago County

- Man Killed in Shooting Outside Rockford Restaurant

Conclusion

The impending gas tax increase in Illinois represents a significant policy decision with far-reaching implications for residents, businesses, and the state’s infrastructure development. While proponents argue in favor of securing essential funding for transportation projects, critics raise concerns over the financial strain imposed on consumers and businesses already navigating a challenging economic landscape.

In conclusion, the debate surrounding Illinois’ gas tax underscores broader discussions about taxation policy, infrastructure investment, and governmental fiscal responsibility. As the state moves forward with its fiscal plans, the outcomes of these decisions will play a pivotal role in shaping Illinois’ economic future and public trust in governance.