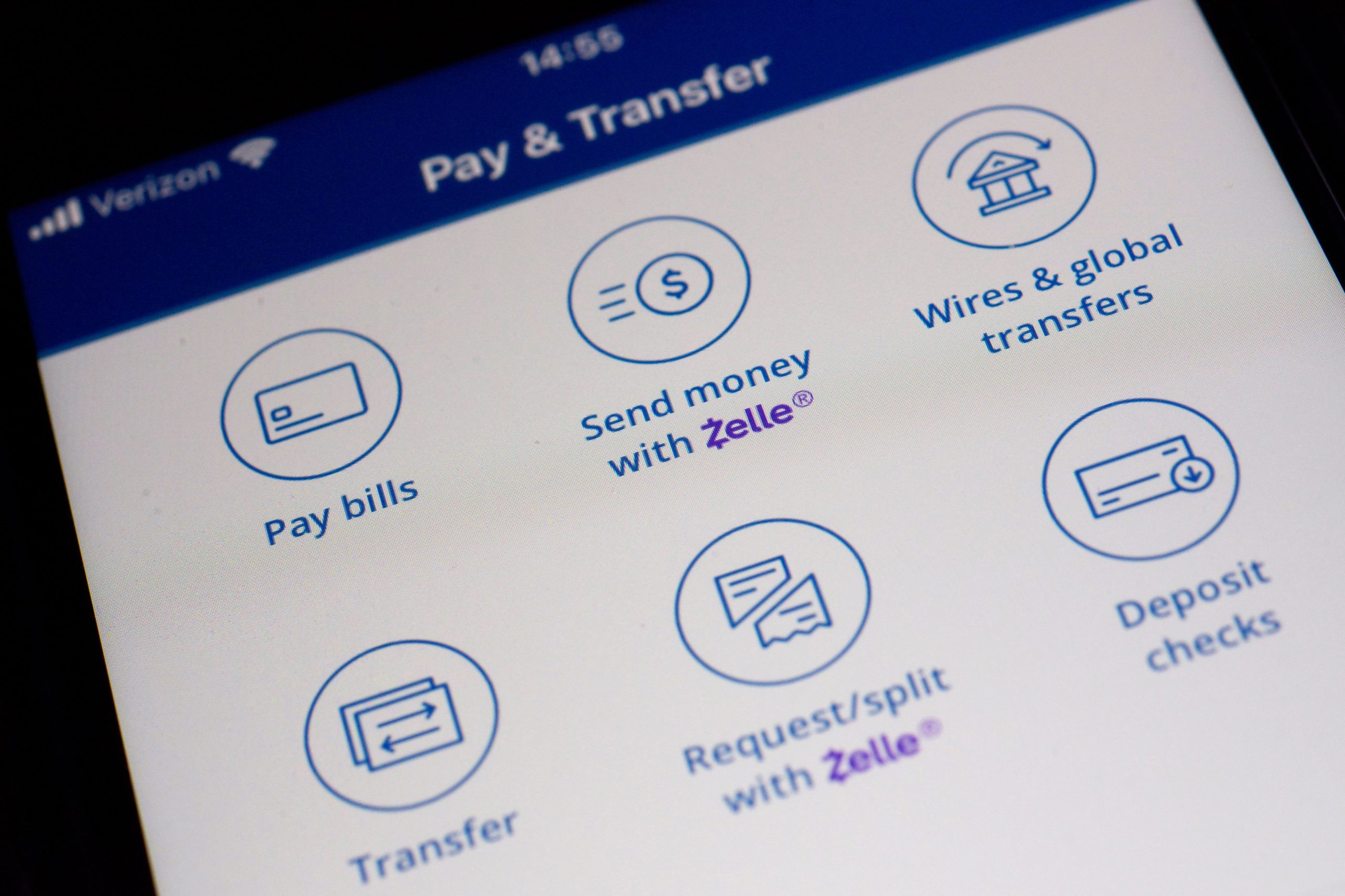

A federal regulator sued JPMorgan Chase, Wells Fargo and Bank of America on Friday, claiming the banks failed to protect hundreds of thousands of consumers from rampant fraud on the popular payments network Zelle, in violation of consumer financial laws.

The Consumer Financial Protection Bureau claims in the federal civil complaint that the banks hurried to launch the peer-to-peer payments platform without adequate fraud protections and then mainly refused consumers relief after they complained about being scammed on the platform.

Significant issues, such as fraud against Zelle users, soon surfaced after the company’s inception. However, the complaint claims that defendants failed to take significant steps to remedy these obvious flaws for years.

The CFPB alleges that the banks’ failure to take action to stop and resolve Zelle fraud violated the agency’s prohibition on unfair acts or practices as well as federal consumer financial laws governing electric funds transfers, which require banks to carry out reasonable investigations when customers report transaction errors. To cover refunds, damages, and penalties, the agency is requesting an undisclosed sum of money.

approximately the course of the network’s seven-year existence, customers of the three banks cited in today’s case have lost approximately $870 million as a result of these failures, according to the CFPB.

The lawsuit also names Early Warning Services, a Scottsdale, Arizona-based fintech business that runs Zelle, as a defendant. EWS is owned by seven U.S. banks, including JPMorgan, Wells Fargo and Bank of America. Those three banks are the largest financial institutions on the Zelle network, accounting for 73% of activity on Zelle last year.

Bank of America said it strongly disagreed with the lawsuit, which it said would add huge new costs on banks and credit unions offering the free Zelle service to clients. It said more than 99.95% of transactions across the Zelle network go through without incident.

According to the Charlotte, North Carolina-based bank, we deal directly with clients when they have problems.

In a statement, New York-based JPMorgan said the CPFB was overreaching its authority by making banks accountable for criminals.

Wells Fargo, situated in San Francisco, chose not to respond to the lawsuit.

Early Warning called the lawsuit legally and factually flawed.

Zelle leads the fight against scams and fraud and has industry-leading reimbursement policies that go above and beyond the law, the company said.

Since its launch in 2017, Zelle has become one of the most widely used peer-to-peer payment networks in the U.S., with more than 143 million users. In the first half of 2024, Zelle users transferred $481 billion across more than 1.7 billion transactions, according to the CFPB.

— Alex Veiga, The Associated Press

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!