The City of Houston intends to regulate the short-term rental industry by requiring properties to be registered with the city and pay a $250–$275 charge. In addition to landlords and neighbors in specific neighborhoods, the market also consists of properties listed on websites such as Airbnb and the Expedia Group.

Additional requirements include paying a hotel occupancy tax, maintaining a $1 million liability insurance policy in place during rental availability, adhering to the Code of Ordinances addressing noise and sound levels, and controlling solid waste and litter.

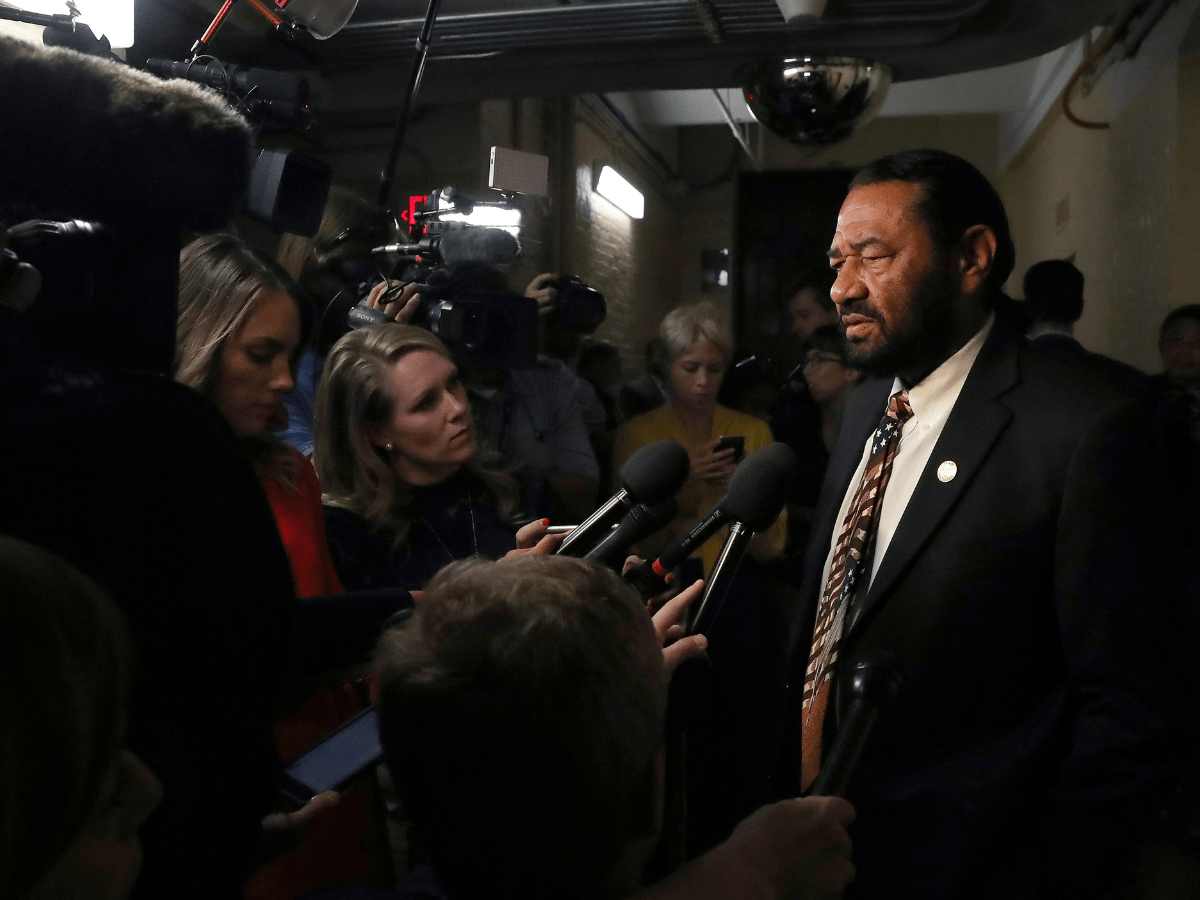

According to Julian Ramirez, a member of the municipal council, “we don’t want to ban short-term rentals because that would be illegal and unconstitutional.” Our goal is to target the bad actors—those who are breaking the law and letting tenants interfere with the lives of other residents by engaging in unlawful activities out of short-term rentals.

Out of 188 responses to a survey done via a site, 58% are in favor of the regulations and 42% are against them.

Other requirements

According to the rules, operators of short-term rentals must reveal the

- maximum number of occupants,

- emergency and non-emergency information,

- the address to the nearest hospital or urgent care,

- location of the nearest fire station,

- floor plan with evacuation routes and safety measures,

- a 24-hour emergency contact person, and

- A conspicuous location, among others.

According to the guide, short-term rental (STR) registrations may also be cancelled for a number of reasons, such as nonpayment of taxes and insurance and convictions of the owner, operator, or occupant for crimes such as sexual assault, prostitution, human trafficking, unlawful restraint, or kidnapping, among others.

A punishment of $100 to $500 would also be imposed for each infraction, and each day that a violation persists would be treated as a single infraction. The property will be delisted within 10 working days of the city notifying the owner if the STR owner does not list a certificate of registration number, if the certificate of registration has been revoked, or if the registration number is invalid or expired.

What stakeholders said

Landlords have asked whether residences can be rented while permissions are pending and voiced concerns about the delays in registration clearances. An other question was whether the city would think about amending the law to grandfather people who now pay Hotel Occupancy Taxes (HOT) so they may keep running their businesses until they get their certificates.

Furthermore, what documentation can be provided to the City as landlords do not receive invoices from the platforms for paying these taxes? Additionally, they stated that the $1 million proof of insurance is excessive and that the landlord must be on one of the two main platforms in order to obtain this amount of coverage, which will make it difficult for people to enter and utilize properties.

In response, Airbnb stated that it currently pays its hosts’ HOT taxes. Can an owner’s presence on the City’s platform serve as evidence that they have paid their HOT taxes? The business inquired.

Additionally, according to Airbnb, it is troublesome to require a registration certificate before a house may be rented or leased. They claimed that even with umbrella coverage, hosts could not obtain more than $500K, and that $1 million insurance coverage is expensive and difficult to find. Conversely, the Expedia Group endorsed the rules and had no issues with the majority of them.

Citing their lack of control and knowledge over a tenant’s behaviors, landlords, Airbnb, and Expedia Group also opposed landlords being held criminally liable for tenant behavior. As a result, they declined to accept responsibility for those acts.

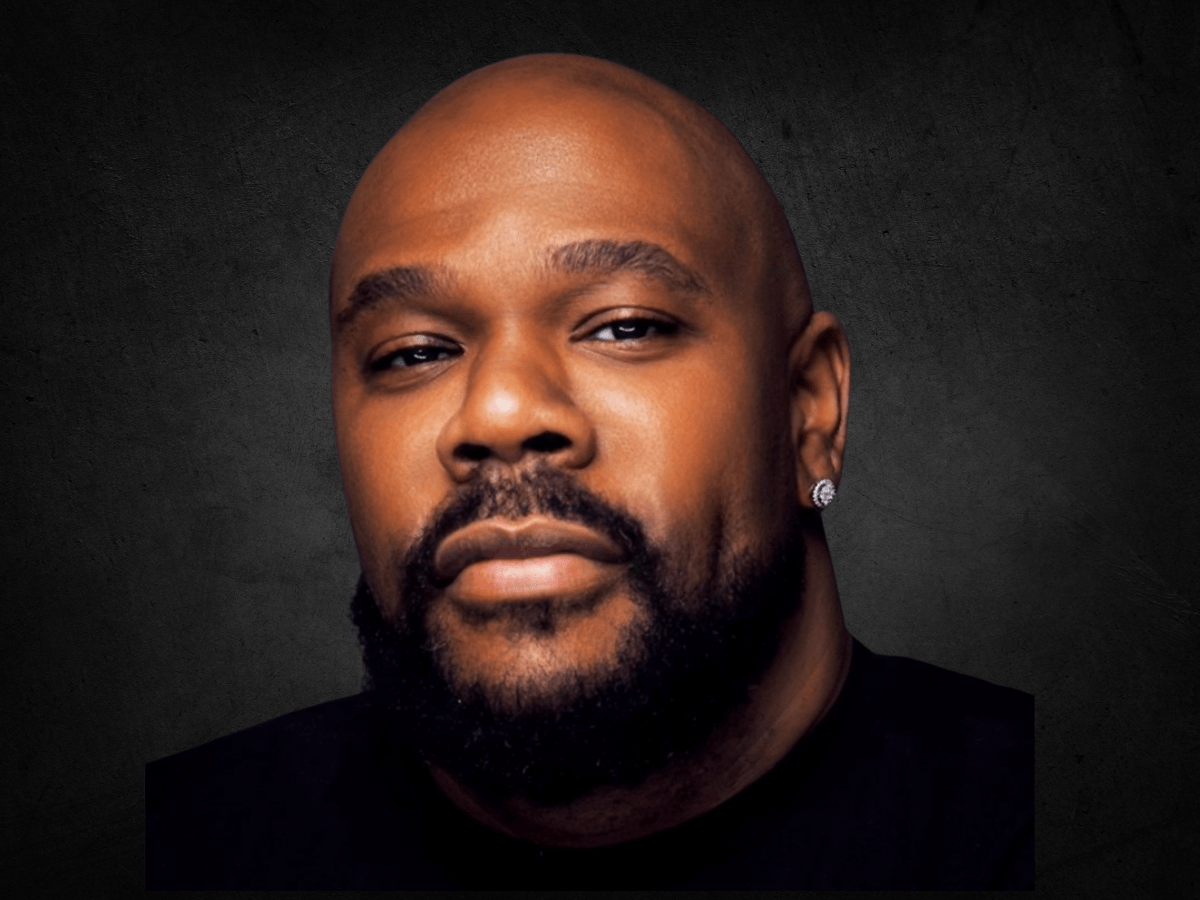

These rules should be put into place, according to Derek Nesbitt, an Airbnb owner in Houston who opened her company there in December 2023 and currently owns two Airbnb apartments.

Although I am aware that many states and cities are not attempting to outright prohibit Airbnb, putting these rules in place would be the best course of action. More than anything else, it serves as a safety net for the city, the area, and the community. “Nesbitt said.” In my opinion, it will only have an impact on Airbnb operators if they fail to comply or if their market is small. Therefore, I could see it hurting them if their audience isn’t that large because they suddenly have to pay all these additional fees when their market isn’t that large and they’re barely making ends meet.

She also thinks that fewer neighbors would complain about Airbnbs as a result of the STR rules.

What the data says

As of October 10, 2024, the Houston Administration and Regulatory Affairs Department had found 8,548 short-term rentals throughout the city, 6,719 (~79%) of which were linked to a street address.

640 properties dialed 311 and 2,756 out of 4,670 called the Houston Police Department in a single year ending November 10, 2024.

Additionally, the study discovered that 77% of all STRs are situated in hotspots—areas with the greatest HPD call volumes.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!