Illinois Governor J.B. Pritzker has signed a new law to help families convert unused college savings funds into retirement savings. This legislation aims to provide financial flexibility for families who have leftover money in their college savings accounts.

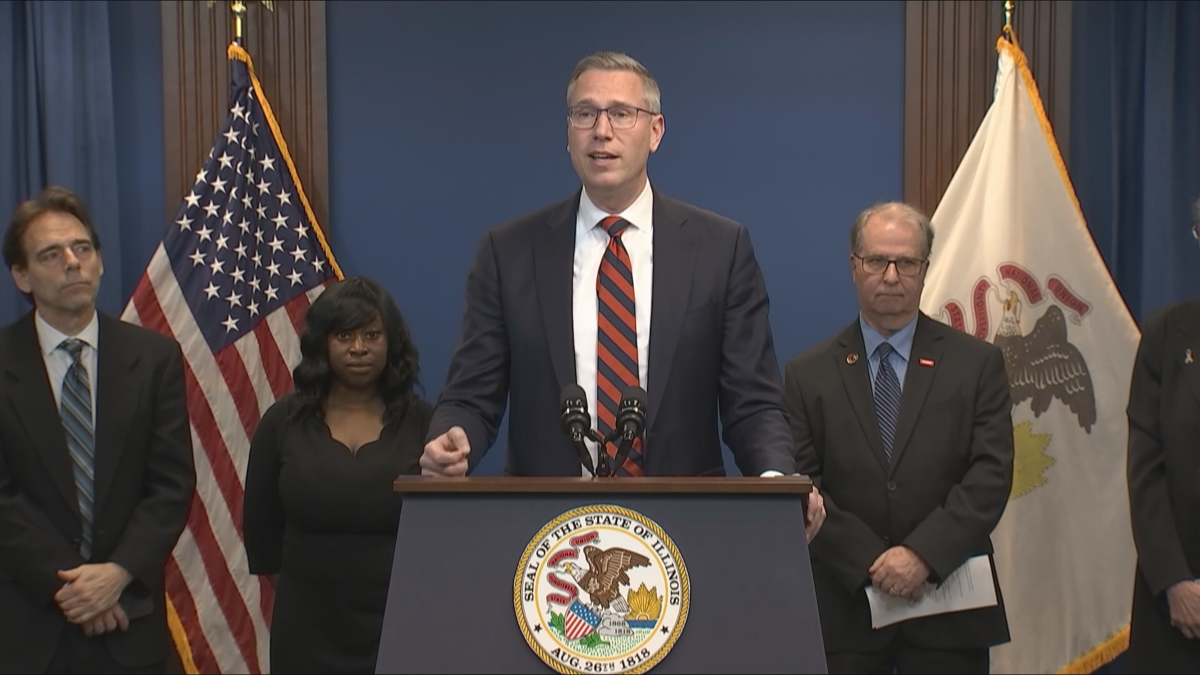

Treasurer Michael Frerichs and state lawmakers discussed this initiative at a press conference in Chicago back in March. Frerichs highlighted that families who do not use all the money in their college savings accounts can now transfer these funds into a Roth IRA. This change follows a bill passed by Congress in late 2022 that allows tax and penalty-free rollovers from college savings plans to retirement accounts.

“People are going to be saving their own money into these accounts,” Frerichs said. “But if we don’t make it easier for people to save, if we don’t give them more incentives to save and they’re unable to retire, for young people entering the workforce, those are positions that won’t be available.”

Senator Steve Stadelman (D-Rockford) and Representative Diane Blair-Sherlock (D-Villa Park) also spoke in support of the law. They emphasized that it is a practical solution that benefits parents, grandparents, and guardians who have opened savings accounts for their children.

This new legislation is seen as a common-sense change that can significantly ease the financial burden on families. By allowing unused college savings to be rolled over into retirement plans, the law provides a way to maximize the benefits of saved funds without incurring penalties.

The move to enable these rollovers into Roth IRAs is expected to encourage more families to save, knowing they have a flexible option for their funds if they are not used for education. This flexibility is crucial for ensuring that saved money is utilized effectively and can contribute to a secure financial future.

Frerichs pointed out that making it easier for people to save is essential for the overall economic well-being of the state. He stressed that if individuals cannot save adequately for retirement, it can impact job availability for younger generations entering the workforce.

The new law is part of broader efforts by the Illinois government to enhance financial security for its residents. By aligning state policies with federal legislation, Illinois aims to provide more options for its citizens to manage their savings and plan for the future.

Also Read:

- Governor Pritzker Signs Law to Reduce Pregnancy-Related Risks for Black Women

- New Illinois Legislation Ensures School Vendors Comply with State Literacy Plan

In summary, this new law signed by Governor Pritzker represents a significant step towards financial flexibility and security for Illinois families. It allows for the seamless transfer of unused college savings into retirement accounts, ensuring that funds are used beneficially and without penalty. This initiative reflects a practical approach to financial planning, supporting families in their efforts to save and invest wisely.