Claims regarding Donald Trump’s tax policies have sparked controversy and misinformation.

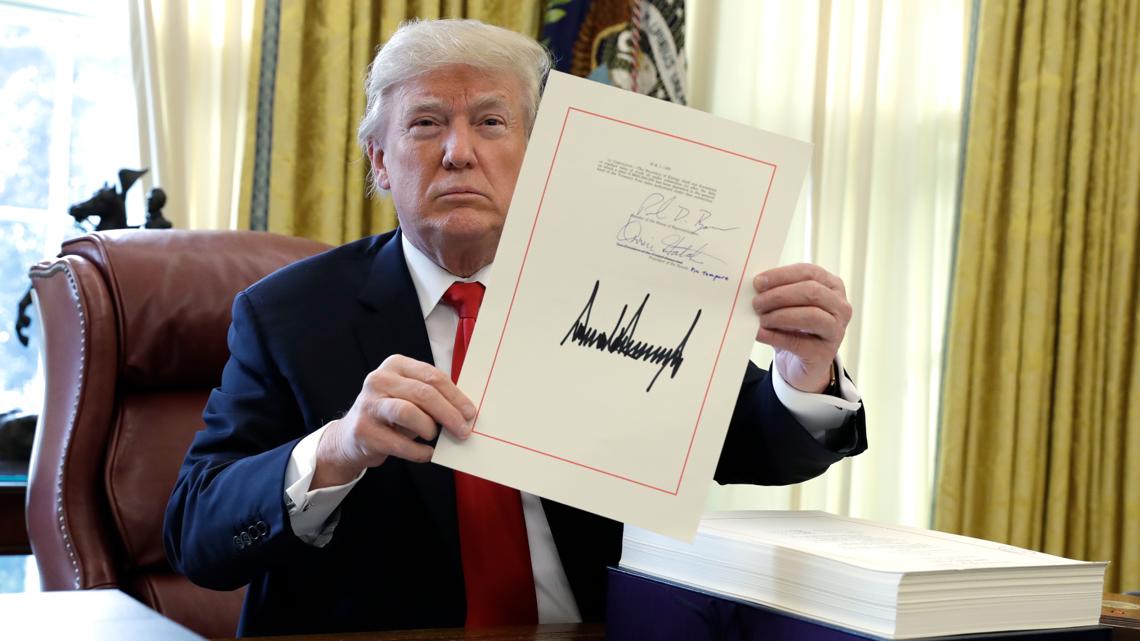

According to a recent fact-check by 5newsonline, claims suggesting that Donald Trump lowered taxes for billionaires while increasing them for others have been debunked. Analysis shows that during his presidency, Trump implemented tax cuts that primarily benefited corporations and high-income earners. These reductions were part of broader tax reform efforts aimed at stimulating economic growth and job creation.

Critics argue that Trump’s tax cuts disproportionately favored the wealthy, contributing to income inequality. However, assertions that his policies raised taxes on average Americans have been refuted by tax experts and independent analyses. While some deductions and credits were modified, overall tax burdens for middle and lower-income brackets did not significantly increase as claimed.

The debate over Trump’s tax policies highlights ongoing political divisions regarding economic fairness and fiscal responsibility. Supporters of the former president point to reduced corporate tax rates as a catalyst for business expansion and increased wages. Opponents counter that these benefits were not evenly distributed across income levels and did not result in substantial economic gains for the majority.

In response to criticisms, Trump’s administration defended its tax agenda as necessary for boosting competitiveness and reversing economic stagnation. Proponents argue that lower tax rates incentivize investment and entrepreneurship, leading to broader economic benefits over time.

Also Read:

- Kristi Noem Indicates She Hasn’t Formally Vetted Trump for Running Mate

- Governor Pritzker Signs Bill to Alleviate Nearly $1 Billion in Medical Debt for Illinois Residents

As the United States continues to grapple with tax policy debates, the legacy of Trump’s tax reforms remains a contentious issue. While some view his approach as a catalyst for economic growth, others emphasize the need for equitable taxation policies that address income disparities and promote inclusive prosperity.