David A. Katz, the president and general manager of his parents’ check-cashing company, was sentenced to four years in federal prison by a judge on Monday for encouraging what prosecutors described as a tax evasion conspiracy to conceal over $170 million in salaries.

The case was one of the biggest tax evasion cases ever charged in Oregon, according to the prosecution.

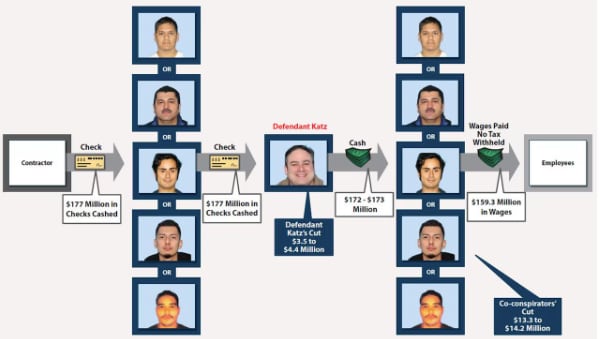

According to Assistant U.S. Attorney Robert S. Trisotto, Katz cashed more than 19,000 checks totaling $177 million that were sent to his company, Check Cash Pacific Inc., by a few construction workers and fraudulent subcontractors.

According to Trisotto, this made it possible for the employees to avoid paying around $45 million in payroll and personal income taxes between 2014 and 2017.

According to the prosecutor, Katz was the cashier at the company, which had seven locations in Oregon and one in Vancouver, and was in charge of cashing every dollar of the checks.

Katz and his attorney made the case for mercy, claiming that he was a good son who stood in for his parents, the company’s owners.

“He’s basically a mule,” defense lawyer Aaron Katz said. David Katz, who is married to his cousin, is connected to the lawyer by marriage.

The defense lawyer pointed out that David Katz is a married father of two teenage sons with no criminal background and blasted the government for not bringing charges against the actual tax evaders.

David Katz told U.S. District Judge Karin J. Immergut that his mother spoke to two of the men who presented checks to the family company in Spanish, explained to him that their checks were valid, and introduced him to them as excellent clients.

He claimed that I learned to respect and follow my parents. I was afraid of disappointing them.

He claimed he never realized he was being mislead.

David Katz read from a statement to the court, “I stand before you broken and ashamed.”

Immergut claims that his parents disputed their son’s account in a private letter to the judge. During the trial, they did not testify.

Following a seven-day trial, a jury in June found 48-year-old David Katz guilty of four charges of submitting false currency transaction reports and conspiracy to defraud the United States.

Katz had one of the main schemers on speed dial, according to the prosecution. Over the course of the scheme, the check-cashing establishments made over $4 million in commissions, and he received between 2% and 2.5% of each check cashed.

Trisotto had asked for a six-and-a-half-year sentence for Katz. Given the extent of the tax fraud, he said the sentence was on the low end of sentencing standards, but it was still long enough to send a message to anyone who might wish to follow Katz’s example.

In addition to cashing tens of thousands of checks, Katz allegedly omitted information from the Internal Revenue Service, filed fraudulent regulatory reports, and threatened an alleged collaborator when IRS officials began to interrogate him, according to Trisotto.

Katz’s attorney recommended home detention or probation.

Aaron Katz stated that the government would have brought charges against the tax-evading construction enterprises if it had been so determined to deter.

According to him, a psychologist who assessed David Katz in August came to the conclusion that he is a high-functioning adult on the autistic spectrum who is rigid, highly regulated by rules, and does his best to follow instructions but misreads social cues and other nuances.

According to his attorney, David Katz should never have been assigned to the position he occupied at the family firm.

According to Aaron Katz, David Katz and his family are on the verge of bankruptcy because his parents, Howard and Sandy Katz, have subsequently disowned him and relocated to Florida.

According to his wife, David Katz has relocated to Tucson with his family and is currently a window salesman.

Immergut stated that she concurred with the jury’s conclusion that David Katz purposefully attempted to deceive the IRS.

She claimed that without Mr. Katz’s check-cashing, the plot would not have been possible.

His income increased from roughly $75,000 in 2014 to $724,000 by 2017, she said.

Immergut, however, stated that she thought the prosecutor’s suggested sentence was excessively lengthy.

She claimed to have considered deterrence in light of Katz’s personal traits, community service, age, and history of crime-free living prior to this case. She stated she considered it, but came to the conclusion that his autistic spectrum diagnosis had nothing to do with the crime.

Immergut agreed to suggest that he serve his term at a satellite camp at the federal prison in Tuscon and ordered his surrender on March 20 to begin it.

Katz’s attorney stated that he plans to file an appeal and ask that the prison sentence be postponed while the appeal is pending.

Two rows of the public gallery were occupied by the defendant’s supporters. He is a kind and devoted parent and husband who works to serve others, according to his former rabbi and his wife.

Rabbi Ken Brodkin, who currently works for a synagogue in central New Jersey but was previously a member of Portland’s Congregation Kesser Israel, flew back to Oregon to attend the sentence. David Katz has led a modest life, he added. In contrast, Brodkin claims that his parents are now disparaging him despite owning extravagant residences and beautiful cars.

The second defendant in the plot to get a sentence is Katz. One of the individuals who brought him checks received a two-and-a-half-year prison sentence.

According to court reports, two more are awaiting sentencing, one is awaiting trial, and one is still at large.

Prosecutors say the six are just the beginning. They claimed that the use of false names had prevented the discovery of numerous other participants.

In court documents, prosecutors stated that this tax evasion scheme has been a part of Oregon’s residential building business for 20 years. Prosecutors admitted that hundreds of workers, subcontractors, and owners of construction companies had committed similar offenses but were not named in this probe.

Tony Bennett, a government witness at trial and one of the owners of a construction company in Hillsboro, acknowledged on the witness stand that he had received immunity from prosecution and from having to pay $4 million in taxes in exchange for his testimony.

Bennett cut checks to a phony subcontractor without withholding payroll taxes, according to investigators. Bennett said that after his company, Titan Exteriors of Hillsboro, secured a significant contract to install windows or exterior siding on new homes, he sought out more workers to augment his company’s 12 to 15 existing staff. Bennett would write a check to the fraudulent subcontracting business for the work, have someone cash it, and use the money to pay the other men who were working for him behind his back.

Bennett stated that many temporary employees will only work for pay. We had to finish the job.

— Maxine Bernstein writes about criminal justice and federal courts. You can contact her via mbernstein@oregonian.com, 503-221-8212, X@maxoregonian, or LinkedIn.

Your support is essential to our journalism. Sign up for OregonLive.com now.

Stories by

Maxine Bernstein

-

Judge bars Grants Pass from taking enforcement action against homeless campers for 2 weeks

-

Hillsboro woman s fentanyl overdose death leads to federal charges against 3 alleged dealers

-

New lawsuit thrusts Oregon city once again into national spotlight on homelessness

-

Oregon drug trafficker busted third time; caught running $2M pot and shroom op

-

Oregon county that used a $1 lease to target homeless camp faces federal lawsuit