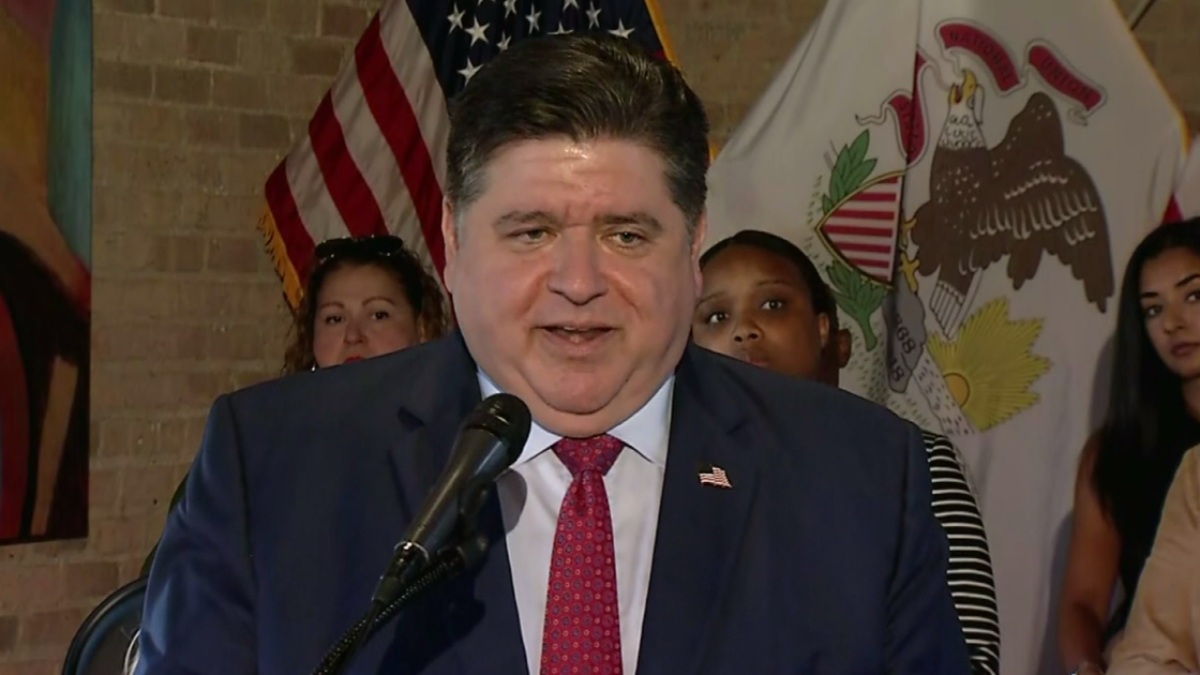

Governor JB Pritzker’s decision to repeal Illinois’ 1% grocery sales tax has stirred controversy, particularly among local government officials. While the move is intended to offer minor relief to shoppers, it is projected to create significant revenue shortfalls for municipalities across the state.

The grocery tax, which previously contributed to municipal budgets, will now be eliminated. This change is expected to result in substantial annual losses for cities. For instance, Chicago stands to lose between $60-80 million, while other cities such as Aurora and Champaign are also bracing for severe budget impacts. Champaign Mayor Deborah Frank Feinen has already proposed raising the home rule sales tax to mitigate the financial shortfall, effectively shifting the tax burden from groceries to other products.

Local officials are concerned about the potential consequences of these revenue losses. Rock Island Mayor Mike Thoms has expressed worries that without alternative tax increases, essential services like public safety and infrastructure could face cuts. He argues that the repeal, while politically appealing, might not address the financial realities of local governments.

Read More News:

- Residents of South Shore Take a Stand Against Crime and Squatters Near Local Schools

- Pecatonica, IL Abuzz Over Fawn Separation from Mother Causes Local Stir

Many mayors are cautious about openly criticizing the repeal or revealing their strategies for replacing the lost revenue. The consensus is that the grocery tax repeal will likely lead to higher taxes on other goods and services, ultimately offsetting the intended benefit of reducing grocery costs for taxpayers.

Source Article:

Gov. JB Pritzker signs legislation ending Illinois grocery tax in 2026