The Consumer Financial Protection Bureau issued a rule Tuesday that will prohibit lenders from using unpaid medical bills as a credit history element when assessing prospective borrowers in the United States for business, auto, or mortgage loans.

According to the bureau, millions of families’ credit scores should rise by an average of 20 points when medical bills are removed off consumer credit reports. According to the CFPB’s research, unpaid medical claims are frequently used to reject mortgage applications even though they are a poor indicator of a borrower’s capacity to repay a loan.

Last year, Experian, Equifax, and TransUnion, the three national credit reporting agencies, announced that they would be excluding medical collections under $500 from consumer credit reports in the United States. By barring all outstanding medical bills from showing up on credit reports and from being used by lenders, the federal agency’s new rule goes one step further.

Although President-elect Donald Trump has suggested significant revisions and restrictions on the CFPB’s regulatory authority, the rule is scheduled to go into effect 60 days after it is published in the Federal Register.

Here’s what you should know:

How many people will this affect?

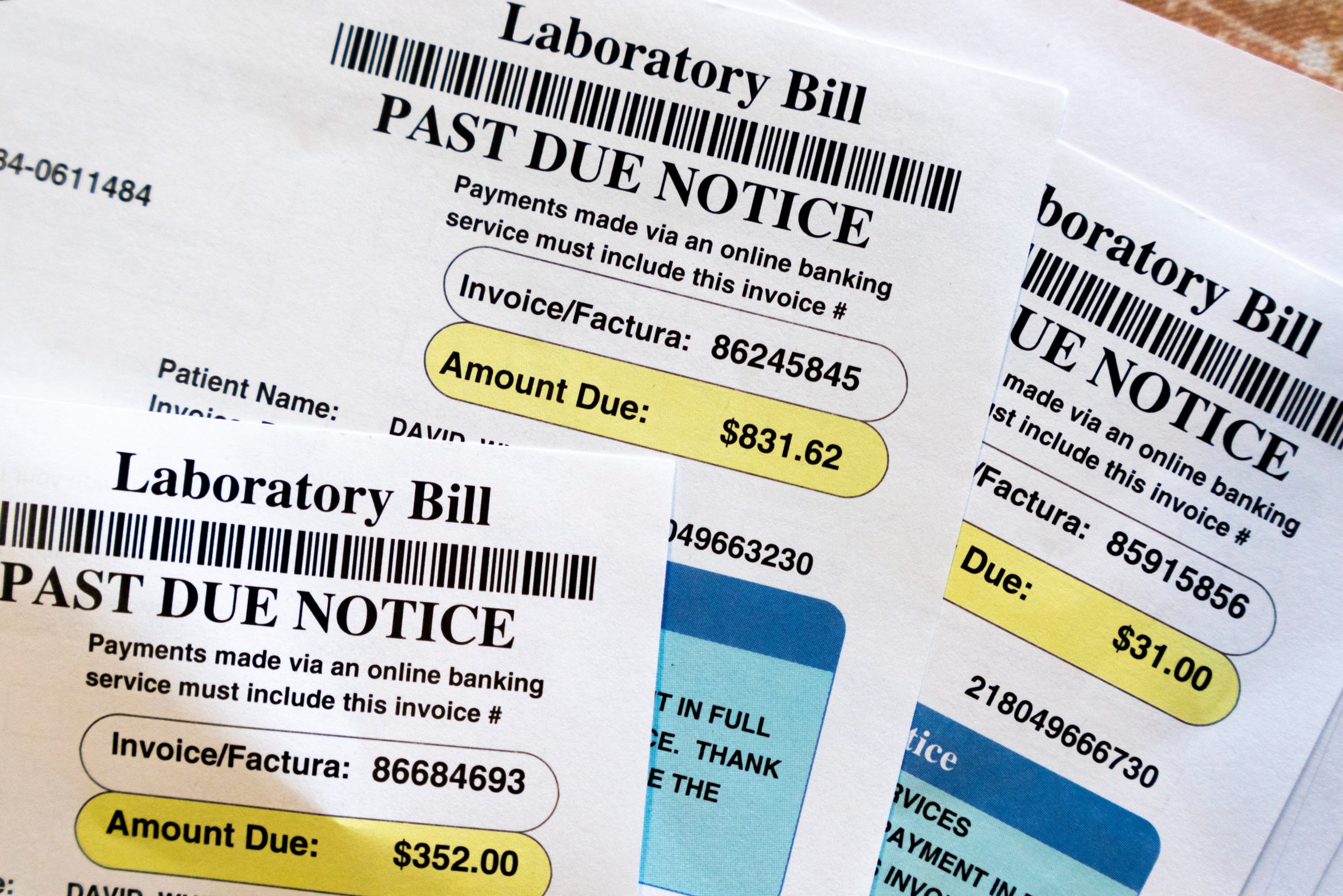

According to the CFPB, 15 million Americans’ credit reports will be cleared of $49 million in medical debt as a result of the rule. The agency reports that more than half of collection entries on credit reports are for medical debts, and one in five Americans have at least one medical debt collection account on their credit reports.

The CFPB has discovered that individuals of color are disproportionately affected by the issue: in the United States, 28% of Black people and 22% of Latino persons had medical debt, compared to 17% of white people. Many people have medical debt numbers on their credit reports that are significantly greater than $500, even though the national credit reporting companies voluntarily agreed to ignore medical debt below this amount.

What will the impact be for consumers?

According to the CFPB, the decision will expand credit availability for millions of consumers and result in the approval of around 22,000 more mortgages annually. According to the bureau, Americans who have unpaid medical bills may see an average 20-point increase in their credit scores.

Additionally, the rule was meant to strengthen privacy safeguards and prevent debt collectors from exploiting the credit reporting system to pressure consumers into paying unpaid bills. According to the CFPB, customers are routinely requested to pay bills that should have been covered by insurance or financial assistance programs, or they are frequently sent erroneous bills.

Additionally, the CFPB’s notice prohibits lenders from utilizing information about medical devices, including prosthetic limbs, to render them subject to repossession and used as collateral for a loan.

How are advocates responding?

The healthcare sector’s nonprofits are happy.

According to Carrie Joy Grimes, founder of the personal finance company WorkMoney, this ruling is fantastic news for regular Americans. Medical debt is not a sign of poor financial management; anyone can get sick or hurt. Americans may now concentrate more on getting back on their feet and less on the burden of medical debt thanks to this new law.

The rule would benefit many financially responsible families who have accrued medical debt due to unforeseen health difficulties, high out-of-pocket expenses, insurance claim denials, and billing errors, according to Patricia Kelmar, director of health care campaigns for the U.S. Public Interest Resource Group.

What should you do after receiving an unexpectedly high medical bill?

Even for people and households with insurance, excessive medical costs are a typical occurrence in the United States, but there are methods to receive relief.

First, find out if you are eligible for charity treatment. Nonprofit hospitals are required by federal law to reduce or waive bills for people based on their household income. Search online for the hospital or healthcare provider and the terms “charity care” or “financial assistance policy” to see whether you qualify. Additionally, Dollar For, a nonprofit, offers patients a streamlined online tool.

Then, file an appeal under the No Surprises Act, a federal law requiring insurance companies to cover out-of-network treatments for emergency and some non-emergency medical care in a reasonable manner. A bill may be unlawful if it exceeds what you are used to or anticipate while using in-network services.

Additionally, always request an itemized bill. Errors and complexity are common in medical billing. The billing codes for all care received are included in an itemized statement. Contesting your bill may result in adjustments if there is a discrepancy between these codes and the care you received.

Another strategy that may be useful is to compare the bill with the insurance company’s estimations of reasonable service charges. You might have your expenses reduced if the amount you were charged was more than usual. You could even inform the provider that you have a case or take them to small claims court over the disparity.

Lastly, always check the bill against the benefits explanation provided by your insurance provider. The explanation of covered and uncovered expenditures must correspond with the hospital’s bill. If not, you have a further justification for not paying and should request that the provider first cooperate with your insurance company.

You can always challenge health claims with your insurance provider even after completing these procedures if you think there is a reason why the bills should be paid in full or in excess of what the provider originally determined. For assistance, you can also get in touch with your state insurance commissioner.

— The Associated Press’s Cora Lewis

The Charles Schwab Foundation provides funding to the Associated Press for informative and illuminating reporting aimed at enhancing financial literacy. Charles Schwab and Co. Inc. is not affiliated with the independent foundation. The AP bears full responsibility for its reporting.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!